-

Financial administration & outsourcing

Entrepreneurs who outsource financial administration reduce the number of administrative tasks and consequently have more time and space to focus on growth.

-

Financial insight

We help you turn financial data into valuable insights that support you in making well-founded decisions. In-depth analyses of your financial situation will help give you a better idea of where you stand and where the opportunities for growth lie, both in the short and long term.

-

Financial compliance

We make sure your company complies with financial legislation and regulations, with correct financial statements, tax reports and other obligations. From our global network, we support you in managing local and international tax risks.

-

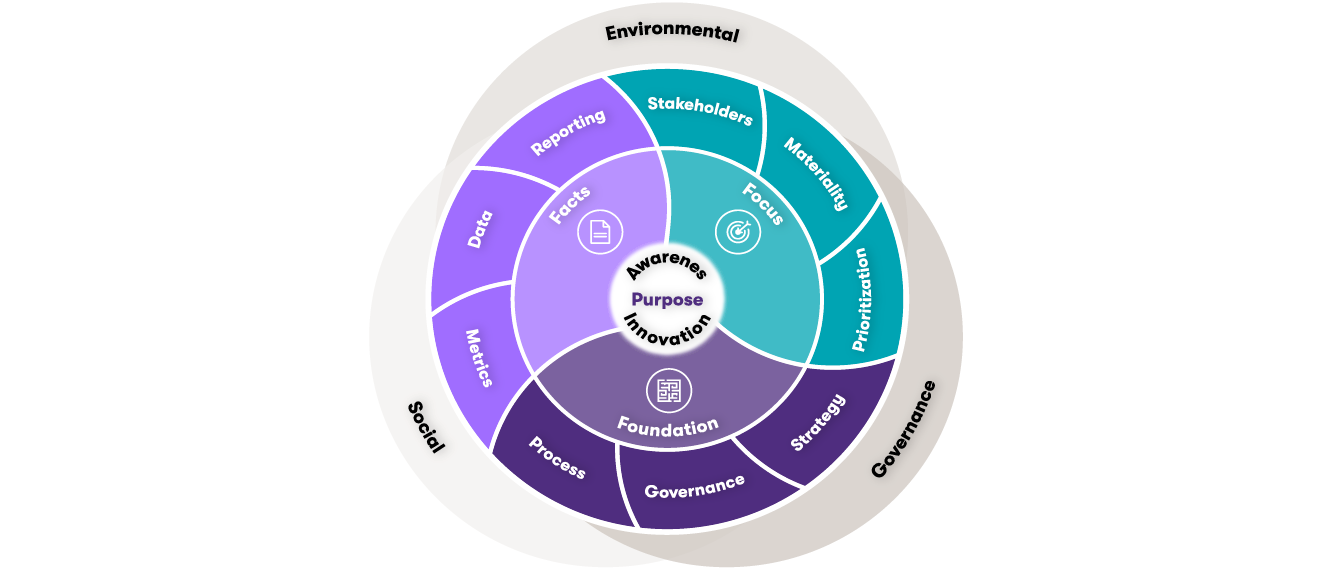

Impact House by Grant Thornton

Building sustainability and social impact. That sounds good. But how do you go about it in the complex world of stakeholders, regulations and frameworks and changing demands from clients and society? How do you deal with important issues such as climate change and biodiversity loss?

-

Business risk services

Minimize risk, maximize predictability, and execution Good insights help you look further ahead and adapt faster. Whether you require outsourced or co-procured internal audit services and expertise to address a specific technology, cyber or regulatory challenge, we provide a turnkey and reliable solution.

-

Cyber risk services

What should I be doing first if my data has been kidnapped? Have I taken the right precautions for protecting my data or am I putting too much effort into just one of the risks? And how do I quickly detect intruders on my network? Good questions! We help you to answer these questions.

-

Deal advisory

What will the net proceeds be after the sale? How do I optimise the selling price of my business or the price of one of my business activities?

-

Forensic & integrity services

Do you require a fact finding investigation to help assess irregularities? Is it necessary to ascertain facts for litigation purposes?

-

Valuations

Independent and objective valuations tailored for mergers, acquisitions, and legal matters.

-

Auditing of annual accounts

You are answerable to others, such as shareholders and other stakeholders, with regard to your financial affairs. Financial information must therefore be reliable. What is more, you want to know how far you are progressing towards achieving your goals and what risks may apply.

-

IFRS services

Financial reporting in accordance with IFRS is a complex matter. Nowadays, an increasing number of international companies are becoming aware of the rules. But how do you apply them in practice?

-

ISAE & SOC Reporting

Our ISAE & SOC Reporting services provide independent and objective reports on the design, implementation and operational effectiveness of controls at service organizations.

-

International corporate tax

The Netherlands’ tax regime is highly dynamic. Rules and the administrative courts raise new challenges in fiscal considerations on a nearly daily basis, both nationally and internationally.

-

VAT advice

VAT is an exceptionally thorny issue, especially in major national and international activities. Filing cross-border returns, registering or making payments requires specialised knowledge. It is crucial to keep that knowledge up-to-date in order to respond to the dynamics of national and international legislation and regulation.

-

Customs

Importing/exporting goods to or from the European Union involves navigating complicated customs formalities. Failure to comply with these requirements usually results in delays. In addition, an excessively high rate of taxation or customs valuation for imports can cost you money.

-

Human Capital Services

Do your employees determine the success and growth of your organisation? And are you in need of specialists which you can ask your Human Resources (HR) related questions? Human Resources (HR) related questions? Our HR specialists will assist you in the areas of personnel and payroll administration, labour law and taxation relating to your personnel. We provide you with high-quality personnel and payroll administration, good HR guidance and the right (international) advice as standard. All this, of course, with a focus on the human dimension.

-

Innovation & grants

Anyone who runs their own business sets themselves apart from the rest. Anyone who dares stick their neck out distinguishes themselves even more. That can be rather lucrative.

-

Tax technology

Driven by tax technology, we help you with your (most important) tax risks. Identify and manage your risks and become in control!

-

Transfer pricing

The increased attention for transfer pricing places greater demands on the internal organisation and on reporting.

-

Sustainable tax

In this rapidly changing world, it is increasingly important to consider environmental impact (in accordance with ESG), instead of limiting considerations to financial incentives. Multinational companies should review and potentially reconsider their tax strategy due to the constantly evolving social standards

-

Pillar Two

On 1 January 2024 the European Union will introduce a new tax law named “Pillar Two”. These new regulations will be applicable to groups with a turnover of more than EUR 750 million.

-

Cryptocurrency and digital assets

In the past decade, the utilization of blockchain and its adoption of a distributed ledger have proven their capacity to revolutionize the financial sector, inspiring numerous initiatives from businesses and entrepreneurs.

-

Streamlined Global Compliance

Large corporations with a presence in multiple jurisdictions face a number of compliance challenges. Not least of these are the varied and complex reporting and compliance requirements imposed by different countries. To overcome these challenges, Grant Thornton provides a solution to streamline the global compliance process by centralizing the delivery approach.

-

Corporate Law

From the general terms and conditions to the legal strategy, these matters need to be watertight. This provides assurance, and therefore peace of mind and room for growth. We will be pro-active and pragmatic in thinking along with you. We always like to look ahead and go the extra mile.

-

Employment Law

What obligations do you have with an employee on sick leave? How do you go about a reorganisation? As an entrepreneur, you want clear answers and practical solutions to your employment law questions. At Grant Thornton, we are there for you with clear advice, from contracts and terms of employment to complex matters such as dismissal or reorganisation.

-

Sustainable legal

At Grant Thornton, we help companies integrate sustainability into their business operations, with sustainable legal at the heart of our approach. We advise on ESG (Environmental, Social, Governance) legislation, and help draft sustainable contracts, implement HR policies, and carry out ESG due diligence in M&A transactions (Mergers and Acquisitions).

-

Maritime sector

How can you continue to be a global leader? The Netherlands depends on innovation. It is our high-quality knowledge which leads the maritime sector to be of world class.

Let's pave the way for a sustainable and tax-efficient future for your business

If you've landed on this page, chances are you are considering embedding sustainability into your business practices (tax-) efficiently. By adopting taxation into your sustainable strategy, it opens doors to investment opportunities in sustainable ventures such as renewable energy projects and sustainable development. Instead of navigating the ever-evolving complexities in-house, we offer our experience and expertise in a cost-efficient manner.

Impact on your organisation

New legislation, codes of conduct, and anti-avoidance initiatives demand a recalibration of tax strategies. Governments worldwide are incorporating tax measures to incentivize ethical practices, fair compensation, and societal contributions. The importance of identifying and managing these opportunities and risks is evident. Companies are facing challenges such as:

- Sustainability policy evaluation: Assessing your company's contributions to energy-saving measures, environmental sustainability, and innovation. Our team offers a quick scan and health check of your sustainability strategy to pinpoint challenges and opportunities.

- Material topics analysis: Gauging the impact of renewable energy use, CO2 emissions, eco-friendly investments, and reducing reliance on fossil fuels. We provide expert guidance to understand the material aspects relevant to your business.

- Transparency reporting: Prepare for increased transparency demands in reporting and communication, ensuring compliance with constantly evolving (global) standards.

- Designing a sustainable tax strategy: Implement, monitor, and evaluate sustainable (tax) strategies and policies tailored to your unique business needs.

- Compliance in an evolving landscape: Staying compliant with the ever-evolving tax and sustainability landscape, incorporating an ethical viewpoint from the community. Our team provides guidance in reporting, describing, applying, and filing to ensure adherence to ethical standards and community expectations.

How we can help you

Our Sustainable Tax team recognizes that aligning with sustainability objectives may disrupt your accustomed business operations. However, we are adept at assisting businesses in integrating ESG (Environmental, Social, and Governance) principles with “green” tax compliance, strategy, and opportunities. Our goal is to not only helping you comply with evolving regulations such as the Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS) but also to ensure your business makes a meaningful impact in the realm of corporate social responsibility.

Our one-stop-shop approach addresses diverse challenges, from navigating intricate reporting requirements to managing implications of the Carbon Border Adjustment Mechanism (CBAM) and ensuring compliance with the EU's Deforestation Regulation (EUDR). Beyond compliance, we excel in optimizing tax benefits through strategic investments in sustainable assets and initiatives.

We understand that embracing sustainable development goals can be a shift from your traditional business practices. Let us guide you through this journey, crafting a tax strategy that not only complies with regulations but also seamlessly aligns with your commitment to sustainability.

Together, let's pave the way for a sustainable and tax-efficient future for your business.

Would you like to get a better understanding of the impact of sustainable tax on your company? And would you like some assistance to take the first step from theory to practice? We can help.

Navigating between obligations and opportunities

As part of a company’s corporate social responsibility, ESG standardization is introduced through regulation for benchmarking, recognizing both incentives ("carrots") and taxation, penalties, and reporting requirements ("sticks"). Incentives include tax benefits and positive recognition for transparent ESG reporting. Yet, you should not solely rely on avoiding penalties for non-compliance as well as taxation and reputational consequences for poor ESG practices.

As ESG disclosures become standardized, they facilitate more rigorous comparisons of corporate performance across diverse criteria. This enables stakeholders to draw insights not only on financial performance but also on a company's purpose and social responsibility. Additionally, ESG reporting provides companies with insights into their standing relative to peers and competitors, aiding in strategic positioning and benchmarking efforts.

Challenges also arise in meeting your stakeholder expectations amidst the evolving regulatory landscape. Beyond compliance, embedding ESG into your culture enhances efficiency, attracts business, and secures lasting benefits. In a competitive labor market, an ESG-focused culture boosts your productivity and talent retention. Go beyond regulations to build a better, resilient future. Conduct culture assessments for sustainable benefits, balancing both regulatory "carrots" and "sticks," including taxation and reporting requirements.

Our services: helping you unlock opportunities and mitigate risks

Beyond traditional sustainability and tax services, we provide expertise in emerging areas that shape the sustainable tax landscape:

CSRD (Corporate Sustainability Reporting Directive) tax reporting

One of the goals of the Green Deal is to channel more capital towards sustainability. It is therefore essential to have transparency and clear, comparable information about what is and what isn’t sustainable. Various policy instruments have been set up for this, such as the most common reporting standard: the Corporate Sustainability Reporting Directive (CSRD), and its implicit yet vital connection with taxation. While the term 'tax' may not be overtly stated, the CSRD significantly influences strategic aspects of material sustainability issues.

Taxation emerges as a multifaceted instrument intertwined with sustainability goals, ranging from influencing behavior through ESG taxes to its pivotal role in the EU Taxonomy. Amid the challenges lie tremendous opportunities: companies reporting under the CSRD must also adhere to the EU Taxonomy, providing a chance to showcase green activities transparently. Explore our collaborative efforts with our sustainability practice from Impact House, empowering businesses to navigate these challenges strategically, transforming them into opportunities for sustainable growth and transparency in the ever-evolving regulatory landscape.

CBAM (Carbon Border Adjustment Mechanism)

CBAM, introduced to prevent 'carbon leakage,' poses complexities in the importation of specific goods into the EU. The current scope includes iron, steel, cement, fertilizers, aluminum, electricity, and hydrogen, with potential extensions to chemicals and polymers by 2026. In the ongoing transitional period since October 1, 2023, entrepreneurs must grapple with quarterly reporting requirements, considering alternative options for obtaining emissions data.

The full CBAM scope comes into effect on January 1, 2026, necessitating strategic planning for compliance, certification, authorization, and reporting processes. Amidst this landscape, explore how we can assist you to assess impacts, gather necessary data, and align with regulatory timelines for a seamless transition into CBAM.

EU’s deforestation regulation (EUDR)

The EUDR prohibits the placing of illegally harvested forests and products derived from illegally harvested forests on the EU market. This initially related to staples like cattle, palm oil, soy, cocoa, coffee, and wood. The EUDR's reach has extended to include rubber, charcoal, printed paper products, and specific palm oil derivatives.

Ensuring compliance demands meticulous due diligence for legal and deforestation-free production. Our Sustainable Tax team specializes in supporting you within these trades, offering insights and assistance during the regulatory transition and beyond. Explore how our services can guide you through the complexities of the EUDR, turning challenges into opportunities for sustainable growth.

Investment Facilities

Countries worldwide provide lucrative tax incentives for investments in environmentally friendly assets, energy-saving initiatives, and sustainable energy projects. However, navigating this landscape presents challenges due to the fragmented legislation globally. Our services not only guide you through these inconsistencies and empower you to capitalize on the abundant incentives available globally.

By strategically leveraging these investment facilities, you not only pave the way for achieving ESG goals but also contribute to the global reallocation of capital towards more sustainable and impactful outcomes. Explore how our services help you navigate the complexities and seize opportunities for sustainable financial growth.

Connecting ESG with Compliance to shape the future

At Grant Thornton, we understand that corporate social responsibility and ESG (Environmental, Social, and Governance) considerations go beyond compliance - they shape the future of responsible business practices. Our one-stop-shop approach connects ESG and sustainability with compliance, ensuring your business is well-positioned to create a positive impact. Whether you seek assistance with the 'carrots' of sustainability benefits or the 'sticks' of compliance obligations, our integrated services empower your business for a sustainable future. Please contact us for more information.